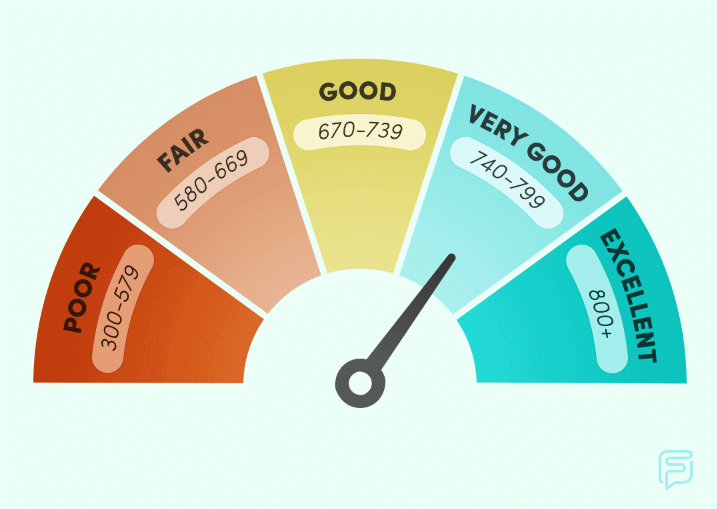

The first step of improving your credit score is reviewing it to see how far you are from your final goal. Some companies may charge you for accessing your credit score. The good news is that we can learn how to see our credit score for free. There are many platforms that make this possible.

Where To Look

Even just 10 years ago, there were not many places Americans could go to get free access to their credit scores. This has drastically changed. One danger of this easy access is that it might also be easier for you to provide sensitive information to scammers. Stick to established and verified credit score providers like the ones recommended below.

Try Your Bank

Traditional and online banks offer free access to your credit score as a standard feature. While not every bank does this, you are spoiled for choice once you start looking. Note that you should have access to your credit score, even if your account is not currently in good standing. As long as you can log into the account, you should be clear. In fact, some banks make it possible for even non-customers to check their scores using their platforms.

Some banks create a separate app for checking your credit score, while others incorporate it into their existing apps. Note that if you check multiple platforms, your score may differ slightly based on the scoring model used by the platform.

These are some of the banks currently offering access to your credit score for free:

- Capital One

- Wells Fargo

- Discover Bank

- American Express

- Citibank

- Bank of America

Check Credit Builder Platforms

Have you taken out any personal loans or credit-builder loans to grow your credit score? These platforms generally offer free access to your credit score. One excellent example of this is Self. These platforms might also feel more committed to sharing tips on how you can improve your credit score. Note that these tips might be tied to using their products and services, so evaluate each offer to ensure it is a good fit for your needs.

Use Aggregate Websites

Chances are that the reason you want to improve your credit score is to make a big purchase or you want a credit card. There are aggregate websites that collect your information, complete a soft credit pull and attempt to connect you with as many potential lenders as possible. Lending Tree is the most popular choice, but you might find several others that offer access to a free credit score.

Use Personal Finance Websites

Personal finance websites are a lot like aggregate websites. They also collect your information and may connect you with credit card and loan offers. However, they share offers instead of share your information with lenders that then reach out to you. These websites also tend to provide access to your credit score. Common platforms that fit into this category include Credit Karma and Nerdwallet.

Personal finance websites provide additional tools that might help you get your finances back on track. For example, Credit Karma might analyze your car insurance payments and recommend lower quotes. Meanwhile, Nerdwallet tracks your net worth, the date you will finally be out of debt and your spending habits, each month.

Ask Experian

Each year, the major credit bureaus owe American consumers access to one free credit report. Your credit report contains the information scoring models quantify to give you that three-digit number, but they do not typically include a score. Experian is the one exception to this. When you request your annual credit report, you can also get access to your FICO 8 scores. If your scores vary widely across the board, you might feel more comfortable getting your score from the source of the data that feeds it.

What To Know

A recent poll found that one in eight Americans don’t know what their credit scores are. One reason people don’t know is that they worry about the potential repercussions of checking their scores. Here are some common questions people may have.

Do I Even Have a Credit Score?

If you have no credit history, then you may not have a score at all. However, if a family member or scammer abused your personal information, you may have a bad credit score and could struggle to fix it.

How Do I Get a Credit Score?

If you have no credit score, start small with secured credit cards and credit-builder loans. You can also ask a family member or friend with a decent credit score to add you to an account.

Will Checking Hurt My Credit Score?

Verify how the platform you use checks scores. All the ones mentioned, so far, do a soft pull. This does not affect your credit score, no matter how often you check it.

After checking your credit score, you might find room for improvement. Securing accounts in good standing at Coast Tradelines can help. Contact us for more information.