With so much uncertainty in the world, you may begin to wonder when non-essential businesses will start to operate again. Nobody really knows for sure if COVID-19 is going to have a second wave, and this is making many Americans uneasy.

You might also have your own uncertainties you’re dealing with. Will you have a job after the pandemic has calmed down? Are you going to receive stimulus payments while you’re in the midst of it? What will a stimulus check do to your credit score? Is there anything you can do to save your credit? Let’s explore some of your most pressing questions and the answers that can help you find peace of mind.

Will I Have a Job After the Pandemic Has Calmed Down?

This is one of those uncertainties we mentioned above. If you have been furloughed, you should speak to your employer about his or her plan for getting employees back on the job. If you are struggling financially in the meantime, you may want to seek temporary employment elsewhere until the pandemic has calmed down enough for you to get back to work. Some industries and companies with current job openings include:

- Restaurants

- Delivery companies

- Grocery stores and bulk warehouses

- Online stores such as Amazon

- Cellphone companies

- Healthcare

If you lost your job completely, many of these essential companies and industries are also looking for permanent employees. Now would be a good time to apply and interview, so as to secure a position while there are so many other individuals staying home and unemployed until the pandemic is all over. You have bills to pay, so you might as well take advantage of the situation you’ve found yourself in.

Where to Find a Job Once the Economy Begins to Open Back Up

As the pandemic begins to calm down and the economy slowly opens back up, many businesses will be looking for new employees. As restaurants are given the green-light for dine-in customers, they may need servers, hosts, waiters and waitresses. As hair salons, massage parlors, spas and other similar business open back up, they could be looking for employees as well. If you’re ready to get back to work, USAJOBS is a good resource.

Will I Receive Multiple Stimulus Payments?

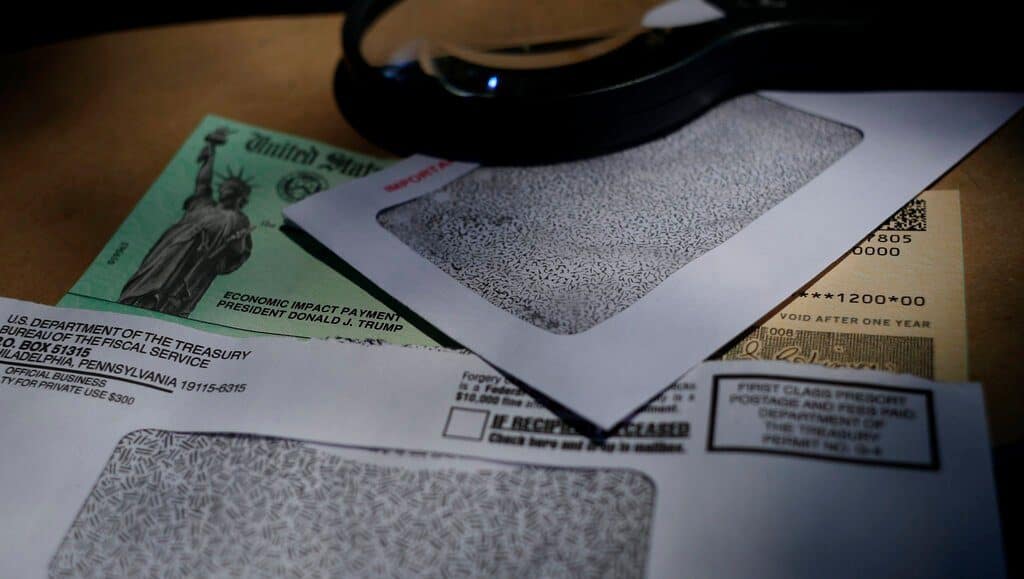

When talk began about sending out stimulus checks, there were various plans presented. One included sending multiple checks to each household. Another included monthly payments. Yet another included just one stimulus check. Though there were a lot of great plans presented, when President Trump authorized a stimulus, it included only a single payment to each household.

That one stimulus check could be a major help if you are financially struggling during this uncertain time. Each adult will receive $1,200, and any qualifying children under 16 years old will receive $500. The amount is based off your 2019 tax return, and if you haven’t filed, the IRS will look to your 2018 tax return. There are some exceptions to the rule, such as married couples filing jointly who make over $150,000 in AGI. The higher your household income, the higher your AGI, and the lower your stimulus check may be.

If you have yet to receive your stimulus check, the IRS has a page dedicated to you. Chances are if you haven’t filed your taxes the last two years, that could be what’s holding it up. If you did file your taxes and had your return mailed to you instead of direct deposited, that could be holding it up as well. Fill in the information on the site so you can get your stimulus check as soon as possible.

Will There Ever Be a Second Round of Stimulus Payments?

Congress and the White House are considering a second round of stimulus payments, which would possibly be sent around July, though the Senate is still holding out. The relief package is evolving, so if it does pass, it may not look exactly how it was proposed. The following are some details about the original proposal, which was already passed by the House.

- It is named The Heroes Act and is a $3 trillion package.

- It includes essential worker hazard pay of $200 billion.

- It includes food and housing assistance, USPS money and six additional months of unemployment.

The way this second round was proposed included the same $1,200 per adult. The difference is a proposed $1,200 for children as well, rather than the first round of $500 for each child. The maximum each family could receive would be $6,000.

With 21.5 million individuals receiving unemployment as of May 23, you can imagine what this second round of stimulus payments could do for the economy. Senate leader Mitch McConnell has suggested a plan to look forward to where Americans will be in a month and coming up with another proposal that is less than the original Heroes Act proposal, so hopefully in the next few weeks, we’ll all have a better idea of what to expect.

Is Anyone Protected From Debt Collectors?

It’ll probably surprise you to learn debt collectors are taking some Americans’ stimulus money. Not every creditor is taking advantage of the situation, but there are some out there collecting what is owed to them. There’s a possibility this will happen to your stimulus check.

The type of debt you have could protect you from debt collectors snatching up your stimulus check. The CARES Act protects against many state and federal debts, so if you’ve defaulted on a federal student loan, for example, your stimulus check will go straight into your pocket. That doesn’t mean you can’t pay your student loan payment with it, but if there is something else that will improve your credit score, you should maybe pay on that first.

Unfortunately, the CARES Act doesn’t protect against private debt collectors. This means private companies can try to seize your stimulus payment. There are many states fighting against these measures, so there is hope in sight for those who are struggling to stay afloat in such defeating times. This doesn’t always make it any easier when you have been searching job openings and trying to keep yourself from debt collection, but those collectors keep coming at you.

How Can Americans Protect Their Stimulus Payments?

Because stimulus payments are being sent in the same way you received your tax return last year, many checks are being direct deposited into bank accounts. This is where the problem lies, as any liens or holds from debt collectors are often satisfied straight from bank accounts. If you can intervene before your payment is sent, you can request a mailed check, cash it at the bank and use the cash as you need it for food, rent, mortgage payments, utilities and other necessities.

What Can I Do Now?

Being in debt doesn’t mean you’ll be struggling forever. There are some quality solutions you could turn to. Before anyone has a chance to claim your stimulus payment, consider purchasing tradelines. This is a way to improve your score during a time that is difficult for most Americans.

Will a Stimulus Check Hurt My Credit?

The short answer? No. A stimulus check isn’t going to affect your credit score in any way. Your credit balances, payment history, age of credit accounts and new credits will have an impact on your score, and receiving a stimulus payment isn’t any of those.

In a roundabout way, however, your stimulus check could actually help you begin to improve your credit. If you’re like many Americans, you’ve probably been struggling with your finances during this pandemic. Perhaps you’ve been sent to collections over your debts, have filed for bankruptcy or have been forced to file for unemployment. With a stimulus check in hand, you can work to pay off some of those debts, in turn saving your credit.

What Can I Do for My Credit History?

Even with your stimulus payment, paying debts among all your other regular bills could be difficult. Is there anything else you can do? Of course! Take a small amount of your stimulus check and purchase an authorized user tradeline. This is a way for you to partner with someone who already has a stellar credit score. That individual’s credit history becomes your credit history, and you both benefit from it. Now you have the score that will allow you to achieve your financial goals during a time when so many people are struggling.

Getting Started Purchasing Tradelines

For all the uncertainties out there right now, there are a lot of certainties as well. If you want a certain way to improve your credit score so you can gain financial stability during this pandemic, AU tradelines will help get you there. Get started today by learning more about AU tradelines.