Ask the Credit Experts: Can Authorized User Tradelines Help You Build Credit?

It’s no secret that you should start building credit while you’re young so you have more borrowing power when you’re older. It’s practically impossible to purchase a car or a house without sufficient credit history. So unless you plan to pay cash for all your large purchases, building credit is imperative. However, new laws have […]

Are Inquiries Really Harming Your Credit?

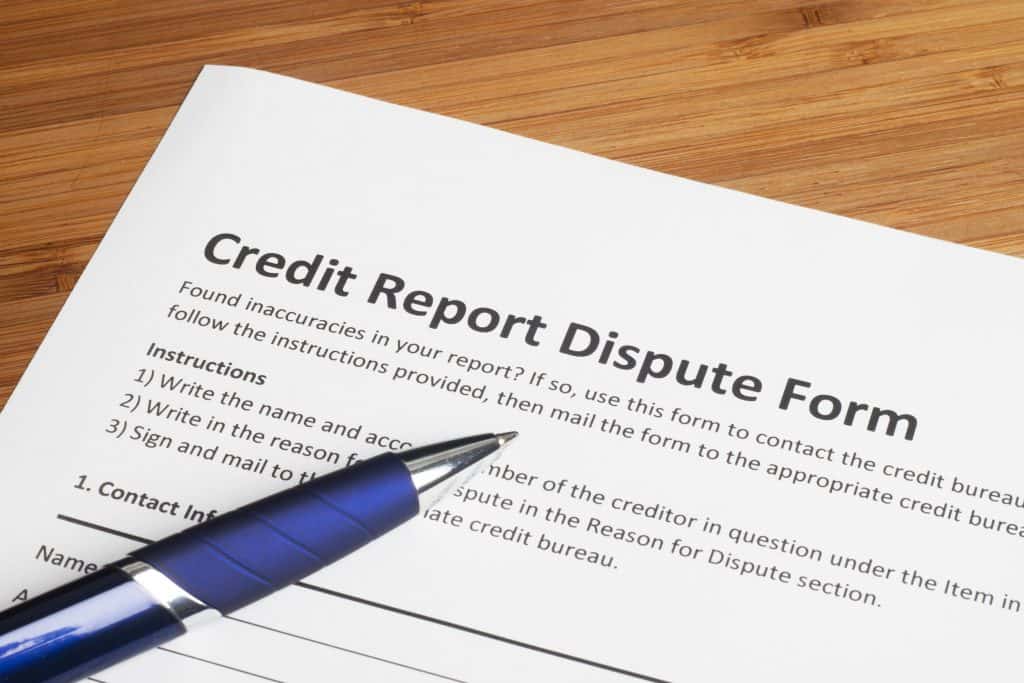

We check things all the time. We check our cell phones for text messages, access our email all day long and look at our bank account to make sure there’s enough cash for that trip to Hawaii. You can view your credit report, too, but if you do that you can put your credit at […]

10 Basic DIY Tips for Credit Repair

When you’re young and have a poor credit history, it may not seem like a big deal. As you grow older, however, you become more reliant on credit to make big changes. A credit score decides not just your ability to buy a car or home, but even to move out on your own and […]

Keep Watch Against Tradeline Myths

Good credit is essential for those who want the better things in life, such as a home or a new car. If you are one of many with less-than-stellar credit, you may still be able to buy these things, but at a higher price because you’ll have to pay a higher interest rate. For some […]

What Does a Derogatory Item on Your Credit Report Mean?

If your credit history is less than perfect, you’ve probably spent a lot of time researching how to repair it. During your research, you may have come across the term “derogatory item” in reference to your credit report. What exactly does this mean and how does it affect your credit score? In its simplest form, […]

Your Guide to Collection Accounts on Your Credit Report

Your credit profile is composed of both your credit report and your credit score. Lenders analyze your credit profile to determine your creditworthiness and to decide whether or not to lend money or extend a credit line to you. Your credit profile also helps determine what type of rates and terms you’ll receive if you […]