What is a Primary Tradeline?

A primary tradeline is an account on a credit report in the name of the principal account owner. Some people think buying a seasoned tradeline is an excellent way to increase their credit score. However, purchasing an aged tradeline is a complex process. It is best to open an account in your own name or […]

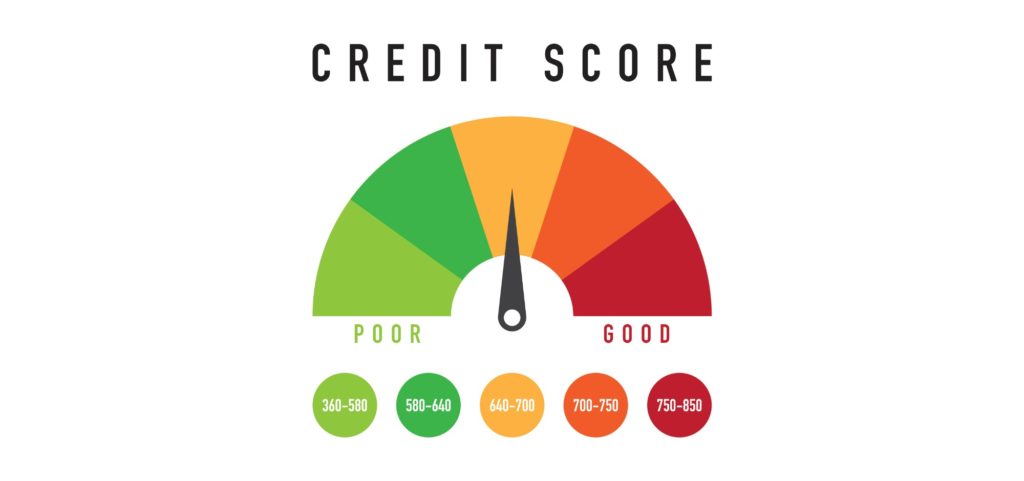

Why Did Your Credit Score Drop?

Periodically, you check your credit score and credit report. Your latest check left you feeling dejected, as you noticed a credit score drop. Coast Tradelines wants to help you understand the many reasons credit scores take a ding. See if any of these explanations apply to you, so you can understand what happened and develop a […]

The Holiday Season – How It Will Impact Your Credit Score

With the holidays coming up, your spending might also go up. The holidays are filled with exciting events, fantastic deals on all your favorite items, and fun get-togethers with the people you love most. Unfortunately, they can also be filled with late payments, fraud, credit applications on a whim, and high card balances. The good […]

The Basics You Need to Know About Tradelines for Sale

One of the best ways to improve your credit score in just a short amount of time is to buy tradelines. While it’s a great way to get ahead financially, you need to know what you’re doing before you actually get involved in the process. The following outlines some basics you should know before purchasing […]

Reaching a Higher Credit Score to Get a Better Credit Card

Credit cards can be your best friend or your worst enemy. They are great when you’re in a bind financially, but that bind can put you in another bind if you’re unable to pay back the balance on your card and it begins to accrue interest. It could have a snowball effect until you find […]

Will Tradelines Still Work In 2022?

It’s estimated that a subprime credit score affects as many as 34.8% of American consumers. Though a low credit score might not seem like a catastrophic issue, if you want to get a loan, credit card, auto financing — or even just approval for an apartment — you can find your credit standing in the […]