A Complete Guide To Collections Accounts

If you are like most people, you’ve had a bill or two go unpaid. Maybe you suffered a job loss and couldn’t make your monthly credit card payments. Perhaps a utility bill went unnoticed when you had a lot going on or it got lost in the mail when you moved. Regardless of why the […]

Using AU Tradelines to Boost Your Credit Score

If you’ve been trying to purchase a home or a new car, you may have hit a few speed bumps with your credit score. Your lender may be unwilling to loan you the money needed because your credit score is a bit too low. That low credit score is an indication that you’re at high […]

What You Need To Know About Collection Accounts and Your Credit Score

If you miss payments on an account in your name, the creditor might report the delinquency after a few months. After some time of that delinquency going unpaid, the creditor might begin collections actions or sell the debt to a company that specializes in this area. Not only are collections efforts an uncomfortable disruption to […]

What’s the Difference Between Credit Scores and Credit Reports?

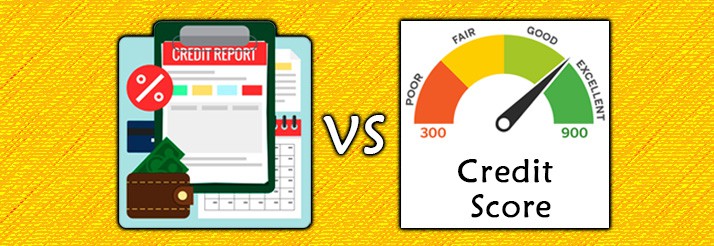

If you are new to the world of credit or to actively building a positive credit history, you might have lots of questions. One of the most common is the difference between a credit report and a credit score. Credit scores provide a quick snapshot of your credit history in the form of one, three-digit […]